១.ទិដ្ឋភាពទូទៅនៃទីផ្សារ និងនិន្នាការ

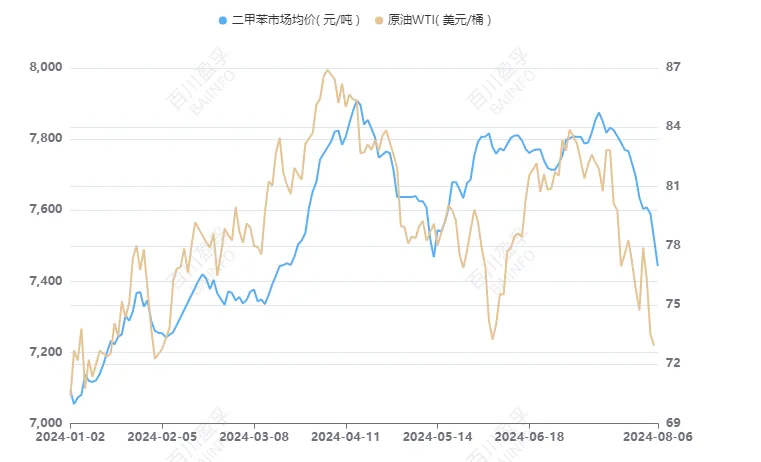

ចាប់តាំងពីពាក់កណ្តាលខែកក្កដាទីផ្សារ xylene ក្នុងស្រុកបានឆ្លងកាត់ការផ្លាស់ប្តូរគួរឱ្យកត់សម្គាល់។ ជាមួយនឹងនិន្នាការធ្លាក់ចុះនៃតម្លៃវត្ថុធាតុដើម ការបិទរោងចក្រចម្រាញ់ពីមុនត្រូវបានដាក់ឱ្យដំណើរការក្នុងផលិតកម្ម ខណៈដែលតម្រូវការឧស្សាហកម្មនៅខាងក្រោមមិនត្រូវបានផ្គូផ្គងប្រកបដោយប្រសិទ្ធភាព ដែលបណ្តាលឱ្យការផ្គត់ផ្គង់ និងតម្រូវការមូលដ្ឋានចុះខ្សោយ។ និន្នាការនេះបានជំរុញដោយផ្ទាល់នូវការធ្លាក់ចុះជាបន្តបន្ទាប់នៃទីផ្សារ xylene នៅក្នុងតំបន់ផ្សេងៗនៃប្រទេសចិន។ តម្លៃស្ថានីយនៅប្រទេសចិនខាងកើតបានធ្លាក់ចុះដល់ 7350-7450 យន់/តោន ធ្លាក់ចុះ 5.37% បើធៀបនឹងរយៈពេលដូចគ្នាកាលពីខែមុន។ ទីផ្សារ Shandong ក៏មិនត្រូវបានទុកចោលដែរ ជាមួយនឹងតម្លៃចាប់ពី 7460-7500 យន់/តោន ធ្លាក់ចុះ 3.86%។

២.ការវិភាគទីផ្សារក្នុងតំបន់

1. តំបន់ចិនខាងកើត៖

ចូលដល់ខែសីហា ការធ្លាក់ចុះជាបន្តបន្ទាប់នៃតម្លៃប្រេងអន្តរជាតិបានធ្វើឱ្យកាន់តែធ្ងន់ធ្ងរដល់ភាពទន់ខ្សោយនៃផ្នែកវត្ថុធាតុដើម ខណៈដែលឧស្សាហកម្មគីមីខាងក្រោមដូចជាសារធាតុរំលាយស្ថិតក្នុងរដូវបិទរដូវប្រពៃណីជាមួយនឹងតម្រូវការខ្សោយ។ លើសពីនេះ ការកើនឡើងនៃការនាំចូល xylene ដែលរំពឹងទុកបានធ្វើឱ្យសម្ពាធផ្គត់ផ្គង់ទីផ្សារកាន់តែខ្លាំងផងដែរ។ អ្នកកាន់ទំនិញជាទូទៅមានអាកប្បកិរិយាធ្លាក់ចុះចំពោះទីផ្សារនាពេលអនាគត ហើយតម្លៃទំនិញនៅកំពង់ផែបន្តធ្លាក់ចុះ សូម្បីតែធ្លាក់ចុះក្រោមតម្លៃទីផ្សារក្នុងខេត្ត Shandong នៅចំណុចមួយ។

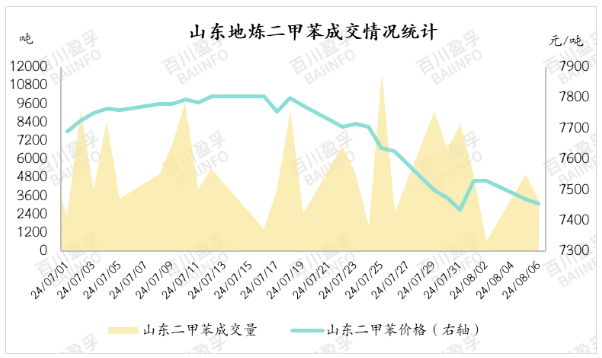

2. តំបន់ Shandong:

ការកើនឡើងតម្លៃយ៉ាងឆាប់រហ័សនៅក្នុងដំណាក់កាលដំបូងនៃតំបន់ Shandong បានធ្វើឱ្យមានការលំបាកសម្រាប់អតិថិជននៅខាងក្រោមក្នុងការទទួលយកទំនិញដែលមានតម្លៃខ្ពស់ ដែលបណ្តាលឱ្យមានឆន្ទៈទាបក្នុងការបំពេញបន្ថែម។ ទោះបីជារោងចក្រចម្រាញ់ប្រេងមួយចំនួនបានអនុម័តយុទ្ធសាស្រ្តកាត់បន្ថយតម្លៃ និងការផ្សព្វផ្សាយក៏ដោយ ក៏មិនមានការជំរុញខ្លាំងនៅក្នុងវិស័យលាយប្រេងខាងក្រោមនោះទេ ហើយតម្រូវការទីផ្សារនៅតែគ្របដណ្ដប់ដោយតម្រូវការចាំបាច់។ គិតត្រឹមថ្ងៃទី 6 ខែសីហា បរិមាណដឹកជញ្ជូនសរុបនៃសហគ្រាសគំរូសហករណ៍រយៈពេលវែងក្នុងការចម្រាញ់ Shandong មានត្រឹមតែ 3500 តោនប៉ុណ្ណោះ ហើយតម្លៃប្រតិបត្តិការនៅតែមានចន្លោះពី 7450-7460 យន់/តោន។

3. តំបន់ភាគខាងត្បូង និងខាងជើងនៃប្រទេសចិន៖

ដំណើរការទីផ្សារនៅក្នុងតំបន់ទាំងពីរនេះគឺមានស្ថេរភាពដោយទំនិញដែលលក់ភាគច្រើនតាមរយៈកិច្ចសន្យា ដែលបណ្តាលឱ្យការផ្គត់ផ្គង់ទំនិញមានកាន់តែតឹងរ៉ឹង។ សម្រង់ទីផ្សារប្រែប្រួលជាមួយនឹងតម្លៃចុះបញ្ជីនៃរោងចក្រចម្រាញ់ ដោយតម្លៃនៅក្នុងទីផ្សារប្រទេសចិនខាងត្បូងមានចាប់ពី 7500-7600 យន់/តោន និងទីផ្សារប្រទេសចិនខាងជើងចាប់ពី 7250-7500 យន់/តោន។

៣.ការរំពឹងទុកនាពេលអនាគត

1. ការវិភាគផ្នែកផ្គត់ផ្គង់៖

បន្ទាប់ពីចូលខែសីហា ការថែទាំ និងចាប់ផ្តើមឡើងវិញនៃរុក្ខជាតិ xylene ក្នុងស្រុកបានរួមរស់ជាមួយគ្នា។ ទោះបីជារោងចក្រចម្រាញ់ប្រេងមួយចំនួនត្រូវបានកំណត់ពេលសម្រាប់ការថែទាំក៏ដោយ អង្គភាពដែលត្រូវបានបិទមុននេះត្រូវបានគេរំពឹងថានឹងត្រូវបានដាក់ឱ្យដំណើរការជាបណ្តើរៗ ហើយមានការរំពឹងទុកនៃការនាំចូលកើនឡើង។ សរុបមក សមត្ថភាពចាប់ផ្តើមឡើងវិញគឺធំជាងសមត្ថភាពថែទាំ ហើយផ្នែកផ្គត់ផ្គង់អាចបង្ហាញពីនិន្នាការកើនឡើង។

2. ការវិភាគផ្នែកតម្រូវការ៖

កន្លែងលាយប្រេងនៅខាងក្រោមរក្សាតម្រូវការសម្រាប់ការទិញសំខាន់ៗ និងផ្តល់នូវការបញ្ជាទិញដែលមានស្រាប់បន្ថែមទៀត ខណៈដែលនិន្នាការធ្លាក់ចុះសរុបនៃ PX នៅតែបន្ត។ ភាពខុសគ្នានៃតម្លៃ PX-MX មិនទាន់ឈានដល់កម្រិតដែលអាចរកប្រាក់ចំណេញបានដែលបណ្តាលឱ្យមានតម្រូវការសំខាន់សម្រាប់ការទាញយក xylene ខាងក្រៅ។ ការគាំទ្រសម្រាប់ xylene នៅលើផ្នែកតម្រូវការគឺមិនគ្រប់គ្រាន់យ៉ាងច្បាស់។

3. ការវិភាគទូលំទូលាយ៖

ក្រោមការណែនាំពីមូលដ្ឋានគ្រឹះនៃការផ្គត់ផ្គង់ និងតម្រូវការទន់ខ្សោយ ការគាំទ្រសម្រាប់ទីផ្សារ xylene ផ្នែកខាងវត្ថុធាតុដើមមានកម្រិត។ បច្ចុប្បន្នមិនមានកត្តាវិជ្ជមានសំខាន់ៗដែលគាំទ្រទីផ្សារនៅលើទំព័រព័ត៌មាននោះទេ។ ដូច្នេះ គេរំពឹងថាទីផ្សារ xylene ក្នុងស្រុកនឹងរក្សានិន្នាការទន់ខ្សោយនៅដំណាក់កាលក្រោយ ដោយតម្លៃធ្លាក់ចុះយ៉ាងងាយ ប៉ុន្តែពិបាកឡើងថ្លៃ។ ការប៉ាន់ប្រមាណបឋមបង្ហាញថាតម្លៃនៅក្នុងទីផ្សារចិនខាងកើតនឹងប្រែប្រួលចន្លោះពី 7280-7520 យន់/តោនក្នុងខែសីហា ខណៈដែលតម្លៃនៅក្នុងទីផ្សារ Shandong នឹងមានចន្លោះពី 7350-7600 យន់/តោន។

ពេលវេលាផ្សាយ៖ សីហា-០៧-២០២៤